This is a change of NA from last month. This finding is consistent with Choi 2015 and Choi et al.

The factors are persistent and correlated with financial market.

2017 mutual fund flows. Mutual Fund Flows and Fluctuations in Credit and Business Cycles Azi Ben-Rephael Indiana University abenrephindianaedu Jaewon Choi University of Illinois at Urbana-Champaign jaewchoiIllinoisedu Itay Goldstein Wharton School University of Pennsylvania itaygwhartonupennedu This Draft. US Mutual Fund Flows is at a current level of 2519B up from -1859B last month and up from -8052B one year ago. This is a change of NA from last month.

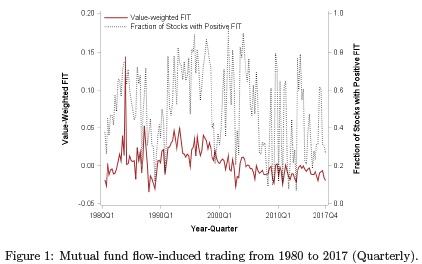

Mutual Fund Flows and Fluctuations in Credit and Business Cycles Abstract We offer an early indicator for credit and business cycles using within-family flow shifts towards high-yield bond funds. Our measure leads net fund flows across all asset classes a year in advance thus forecasting future aggregate demand by fund investors. CHICAGO April 19 2017 PRNewswire – Morningstar Inc.

MORN a leading provider of independent investment research today reported. In November investors placed 166 billion into US. Equity passive funds compared with Octobers 276 billion inflow.

On the active front investors pulled 179 billion out of US. At the end of 2017 total assets in US. Mutual funds and exchange-traded funds reached a new record of just over 18 trillion.

Estimating the fund investors demand plays an important role in the mutual fund management. In this line mutual fund demand can be measured as the total net cash flows experienced by the fund during a period. Due to a lack of the data for inflows and outflows in some countries and databases many authors estimate the net cash flows using fund size and return.

US Mutual Fund and ETF Flows is at a current level of 12072B up from 6088B last month and up from 501B one year ago. This is a change. Swing Pricing for Mutual Funds.

Breaking the Feedback Loop Between Fire Sales and Fund Runs Working Papers 18-04 Office of Financial Research US Department of the Treasury. Yong Chen Nan Qin 2017. The Behavior of Investor Flows in Corporate Bond Mutual Funds Management Science INFORMS vol.

635 pages 1365-1384 May. Our study is closely related to the growing body of research on socially responsible investments in mutual funds that has evolved around the debate on whether sustainable investment flows are driven by financial or non-pecuniary objectives Bollen 2007 Renneboog et al. 2011 Riedl and Smeets 2017 Hartzmark and Sussman 2019 Ceccarelli et al.

WhitepaperRefinitiv Lipper US Fund Flows. Fund Flows Database Historical. Fund Count and Assets.

Refinitiv Lipper US Fund Flows Cash Track. Monthly Fund Complex Aggregates. Largest Monthly Fund Complex Flows.

Fund flows Flows are on average positive 0147 reflecting significant growth for some equity mutual funds over the sample period. R-square ranges between 0706 and 0996 with a mean of 0951 indicating that a significant fraction of the average funds return variability reflects that of Carharts 1997 model factors. Mutual Fund Flows Mark J.

Levi and Russ Wermers Abstract We analyze the flow of money between mutual fund categories finding strong evidence of seasonality in investor risk aversion. Aggregate investor flow data reveal an investor pref-erence for safe mutual funds in autumn and risky funds in spring. Mutual fund inflows and outflows comprise.

Switches pre-authorized contributions systematic withdrawal plans reinvestments and distributions. Each type is uniquely affected. Aggregating different types of flow leads to mistaken inferences about the determinants of mutual fund flow.

Flows are near-monotonic across the five globe categories with five-globe funds having the largest net flows and one-globe funds having the lowest flows between February 20 and April 30 2020. In particular one-globe funds suffer outflows of 26 of assets under management over the 10-week period whereas five-globe funds net flows are roughly zero. Estimated Long-Term Mutual Fund Flows Total estimated inflows to long-term mutual funds were 1381 billion for the week ended Wednesday April 14.

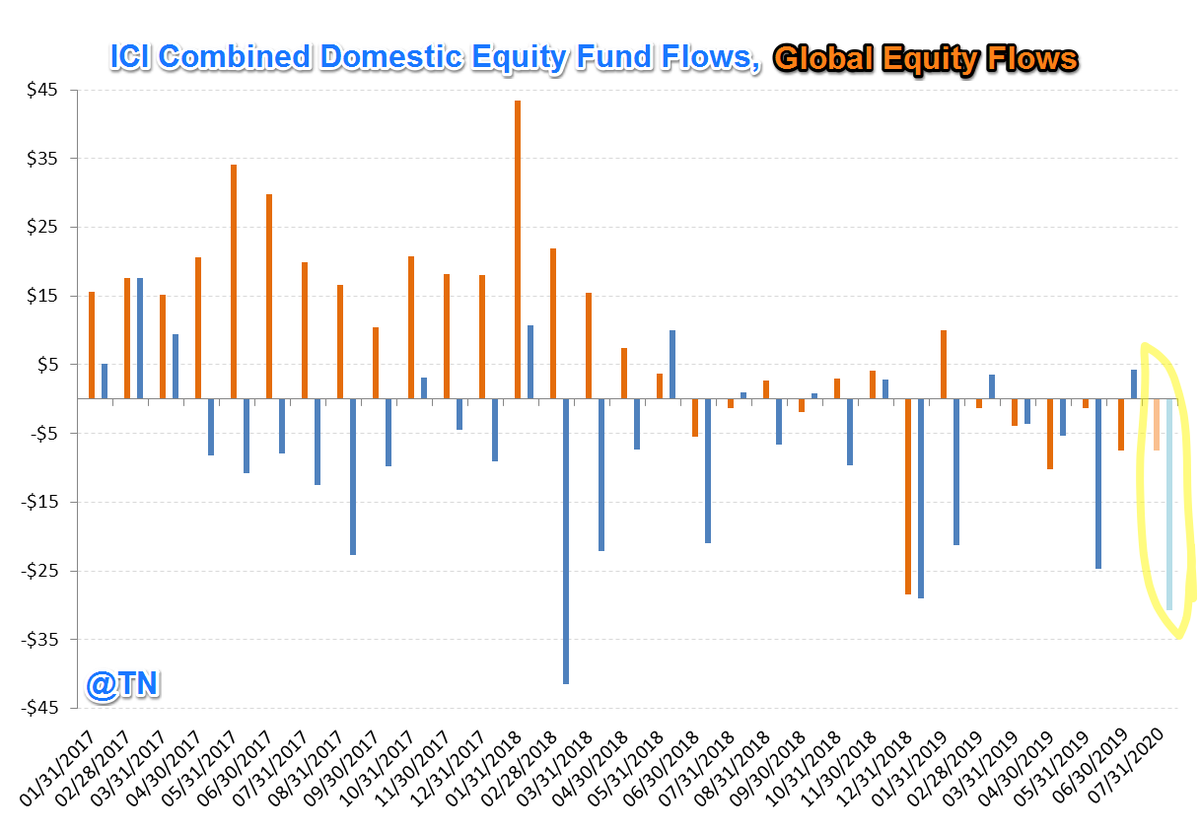

Common factors in mutual fund flows explain significant fractions of annual and quarterly flows to individual US mutual funds. The factors are persistent and correlated with financial market. Equity Fund Flows weekly 1-2 Bond Fund Flows weekly 3 ETF Fund Flows weekly 4 Total Equity Bond Fund Flows 13-week 5 Equity Fund Flows 13-week 6 Bond Fund Flows 13-week 7 All Equity Bond Fund Flows 13-week 8-10.

This finding is consistent with Choi 2015 and Choi et al. 2017 who document a turn-of-the-year effect in mutual fund flows indicating that the observed seasonality in investors asset. This paper establishes a new empirical fact.

Mutual funds flow-performance sensitivity is a hump-shaped function of aggregate risk-factor realizations. Explanations based on extant theories can only explain a fraction of the pattern. We thus develop a new parsimonious model.