When applying game theory to models of competition we saw that individuals have an incentive to deviate from collusive agreements. Thisyieldsthesimultaneoussystemofequations qiriqi foralli1nInthelinearcasetheFOCyieldssinceqiqiq Bq1ABqc1 0 Bq2ABqc2 0.

Thus the profit of each firm depends on the production of the other firms.

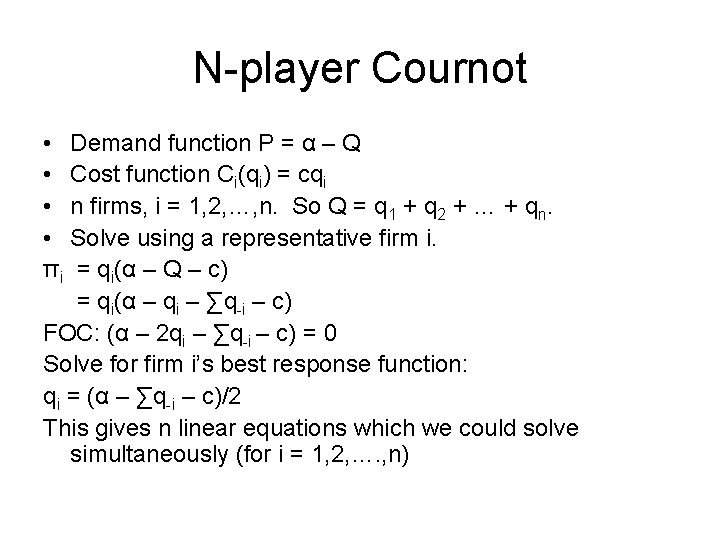

Cournot competition with n firms. Here is how we can think of N-firm Cournot competition. Assume all the firms have the same marginal cost C 0. Firm 1 chooses Q1 Firm 2 chooses Q2 and so on.

The market price P A Q1 Q2. Assume A C. A Solve for the Cournot pure strategy equilibrium.

The firms are all the same so you should expect the equilibrium to be symmetric that is Q1 Q2 QN. In this video I show how to solve for Cournot quantities among n competing firms. I start with very generalized functions and characterize the solution.

Thisyieldsthesimultaneoussystemofequations qiriqi foralli1nInthelinearcasetheFOCyieldssinceqiqiq Bq1ABqc1 0 Bq2ABqc2 0. BqnABqcn 0 Summationyields BqnABqnc0 where c. Of the production of the m firms at a point tn with n units of time offset to a reference tim e t.

Q t1 AQ t C is true suppose that P n is true. Q tn1 AQ tn. Cournot Model n firms - Nash Equilibrium - YouTube.

Cournot Model n firms - Nash Equilibrium. In Cournot competition each firm decides its production quantity simultaneously. The price is determined by the inverse demand function where.

The profit of firm is where is the marginal cost of the production of firm. Thus the profit of each firm depends on the production of the other firms. All firms decide output simultaneously.

They assume competitors output will not change. Another assumption is that companies cannot collude or form cartels. They also have the same view of market demand and are familiar with competitors operating costs.

The Cournot model produces logical results. In the long run prices and output are stable. That is there is no possibility that changes in output or prices will make the firm.

A Duopoly Version of the Cournot Model A Linear Example with n Firms Problems with solution. Merger in a Cournot competition A Comparison of a Di erentiated Bertrand Duopoly and a Di erentiated Cournot Duopoly Industrial Economics EC5020 Spring 2009 Michael Naef February 9 2009 Aims Be able to characterize the Cournot equilibrium. Cournot competition with N firms 20.

From monopoly to perfect competition 21. Wrapping up Some Lessons. When applying game theory to models of competition we saw that individuals have an incentive to deviate from collusive agreements.

The equilibrium is a set of quantities where each person is optimizing given the quantity chosen by the other. Link between classical economics and. Exercise 2 Cournot competition with 3 firms.

Consider three firms competing a laCournot in a market with inverse demand function 𝑃𝑃𝑄𝑄 1 𝑄𝑄 and production costs normalized to zero. Find the psNE of the game when firms simultaneously and independently choose quantities. Determine the equilibrium profit level for each firm.

Three firms are in Cournot competition. The inverse demand curve is denoted p q where p is the price if a total of q units are produced. P 00 and p q0.

The firms have identical and continuous cost functions c q i 0 for all q i 0. Assume c q i 0 c q i 0 for all q i 0. Industrial Economics-Matilde Machado 32.

Cournot Model 15 If the number of firms in the oligopoly converges to the Nash-Cournot equilibrium converges to perfect competition. The model is therefore robust since with n the conditions of the model coincide with those of the perfect competition. This video demonstrates the theory of Cournot competition by working a simple example with two firms common and constant marginal cost and a linear inverse.

Cournot competition is an economic model in which competing firms choose a quantity to produce independently and simultaneously named after its founder French mathematician Augustin Cournot. Cournots model of oligopoly Single good produced by n firms Cost to firm i of producing qi units. Ciqi where Ci is nonnegative and increasing If firms total output is Q then market price is PQ where P is nonincreasing Profit of firm i as a function of all the firms outputs.

In der Volkswirtschaftslehre ist das Cournot-Oligopol eine modellhafte Marktsituation die von Antoine-Augustin Cournot zuerst beschrieben und analysiert wurde. Sie taucht in der Literatur auch unter den Namen Cournot-Dyopol und Nash-Cournot-Gleichgewicht aufIm Cournot-Oligopol wird das Verhalten zweier oder mehrerer Konkurrenten auf einem unvollkommenen Markt beschrieben auf. In this section we introduce an evolutionary competition between the different adjustment processes.

For this we model our Cournot oligopoly as a population game. That is we consider a large population of firms from which in each period groups of n firms are sampled randomly to play the one-shot n-firm Cournot oligopoly. Firms may use different adjustment processes and they switch.

A French economist Augstin A. Cournot has given the duopoly model in his book. According to him the model has a unique equilibrium when demand curve are liner.

The model explains that the two firms choose the output levels in competition with each other. The Cournot model has a continuous strategy.