You dont want to issues company shares during a bear market you do it when there is a bull run. You dont want to issues company shares during a bear market you do it when there is a bull run.

The initial capital structure should be designed very carefully wherever funds have to be procured the financial manager should study the pros and cons of various sources of finance and pick up the most advantageous source keeping in view the target capital structure.

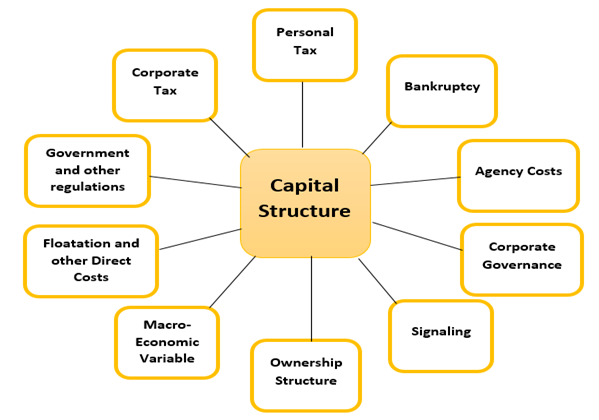

Factors determining capital structure of a firm. Factors Determining Capital Structure. Trading on Equity-The word equity denotes the ownership of the company. Trading on equity means taking advantage of equity share capital to borrowed funds on reasonable basis.

It refers to additional profits that equity shareholders earn because of issuance of debentures and preference shares. The capital structure of a company is a particular combination of debt equity and other sources of finance that it uses to fund its long-term asset. The key division in capital structure is between debt and equity the proportion of debt funding is measured by gearing or leverages.

Theory Myers 1984The capital structure of the firm influences by many factors such as capital intensity tangibility expected growth firm size profitability non- debt tax shields liquidity volatility uniqueness and industry classification Titman. Degree of Control. The level of control the company wants to hold over the business determines its capital structure to some extent.

If it wants to retain a high degree of control it will prefer debts over equity. The capital structure is designed according to the duration for which the company requires the funds. A business having a short-term requirement will not prefer.

The purposes of this study are 1 to determine how these four factors influencing capital structure decisions namely industry variable firm-specific variables stock market circumstance. Factors Determining Capital Structure Capital structure has to be decided initially at the time when a company is incorporated. The initial capital structure should be designed very carefully wherever funds have to be procured the financial manager should study the pros and cons of various sources of finance and pick up the most advantageous source keeping in view the target capital structure.

In the capital structure literature the relevant variables explaining capital structure of firms are based on the three principal theoretical models of capital structure. The trade off theory the pecking order theory and the agency costs theory. Capital structure as its name itself signifies is the composition of the capital employed by the firm from various sources of finance.

It comprises of both owners capital ie. Equity capital and preferred capital and debt capital. The capital structure of the firm represents its investment and financing strategy.

Determinant of Capital Structure Choice. Factors affecting the capital structure as the dependent variable is the independent variable as follows. 1 Collateral Value Of Assets value line of assets 2 Non-Debt Tax Shield NDTS 3 Growth growth 4 uniqueness uniqueness 5 industry Classification type of industry.

Tax rates play a major role in determining the capital structure. In case of high corporate taxes companies prefer debt capital because interest paid on debt is allowed as a deduction while computing a tax liability. Dividend paid on equity and preference share capital are not allowed as tax deduction.

The study suggests that the performance of any company hinges around its ability to operate on a capital structure. With the widening of scope of sourcing of capital the right blend of instruments needs to be meticulously worked out to optimize cost of capital. The Regularity of Earnings -A firm with large and stable incomes may incur more debt in its capital structure unlike the one that is unstable.

Conditions of the Money Markets Capital markets are always changing. You dont want to issues company shares during a bear market you do it when there is a bull run.