Yield Curve The Treasury Yield Curve is the global benchmark for US. It will calculate the yield on a Treasury bill.

This will give you the T.

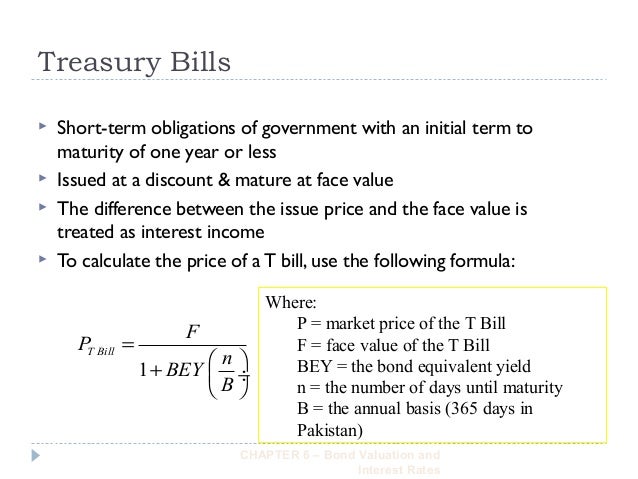

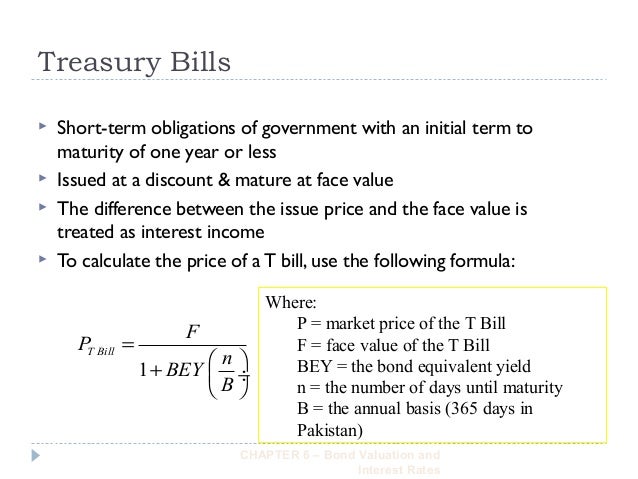

How to calculate yield on treasury securities. Estimating Yields on Treasury Securities Computations of yields on Treasury securities depend on the face value purchase price and maturity of the issue. The yield on a Treasury bill varies depending on its method of computation. The discount method relates the investors.

The discount method. With all these known factors price coupon and principal one can mathematically calculate the yield on a security. Yield is critical when assessing relative worth.

All else being equal risk maturity etc most investors will choose those securities. Doing the calculation In order to calculate the yield start with the quoted ask price which is typically stated in terms that assume a face value of 100. Subtract 100 minus the ask price.

Next multiply the yield you just calculated by 365 and then divide by the number of days in the maturity period that you determined earlier. This will give you the T. There are three yields associated with a US.

Treasury bond and most other types of bonds. Coupon rate is the rate of interest paid based on the face value. A 10000 face value bond with a 6-percent coupon pays 600 per yield in interest.

The current yield is the coupon rate or interest divided by the current price. The formula for calculating the Treasury yield on notes and bonds held to maturity is. Treasury Yield C FV - PP T FV PP2 where C coupon rate FV face value.

When evaluating at a bond there are two primary yield calculations. The current yield and the yield to maturity. Current yield simply is the annual interest amount that a bond pays divided by the current price of the bond.

Multiply the number calculated in Step 4 by the face value of the Treasury bill. In the example if the Treasury bill has a face value of 100 then 100 times 0992222 equals a. MMY is different from BDY as it computes yield based on the purchase price of the security rather than on the securitys face value.

The equation for MMY is. 360 Number of days in a year as per banking conventions t Number of days until maturity. The spread between 2-year US.

Treasury securities and 30-year US. Treasury securities defines the slope of the yield curve which in this case is 256 basis points. How to Calculate the Yield of a Bond To find the real rather than nominal yield of any bond calculate the annual growth and subtract the rate of inflation.

This is easier for inflation-adjusted. Yield Curve The Treasury Yield Curve is the global benchmark for US. Dollar denominated capital markets securities and assets are quoted or priced off this curve.

The curve is typically depicted as a graph with yields along the Y-axis and Maturities along the X-axis. The specific Treasury securities used to construct. The yield on US.

Treasury securities including Treasury bonds T-bonds depends on three factors. The face value of the security how much the security was purchased for and how long it. Yield Discount Value Bond Price 365number of days to maturity 397 36591 003094010989.

So in other words the T-bill offers a return on investment of 124052 but since you held it for 91 days you will enjoy this return on a. Investors calculate risk premium by comparing the difference in yields on a Treasury and a Treasury Inflation-Protected Security TIPS with similar maturities. The result indicates the amount of inflation protection investors should need by representing expected inflation.

Treasury bills are short term securities issued by the US. Theyre sold at a discount to their face value which is the amount theyre worth at maturity. Discount yield essentially the bills interest rate is the rate of return based on the published face value of the Treasury bill.

The TBILLYIELD Function is categorized under Excel FINANCIAL functions. It will calculate the yield on a Treasury bill. In financial analysis TBILLYIELD can be useful in calculating the yield on a Treasury bill when we are given the start date end date and price.

Calculate Coupon Equivalent Yield In order to calculate the Coupon Equivalent Yield on a Treasury Bill you must first solve for the intermediate variables in the equation. In this formula they are addressed as. A b and c.

364 025 4 a Calculate Coupon Equivalent Yield.