Complete loss or no loss at all. Total cost of the insurance policy calculated simply as.

There seems to be full agreement among the leading theoreticians in the field that the insurance premium should reflect both the expected claims and certain loadings.

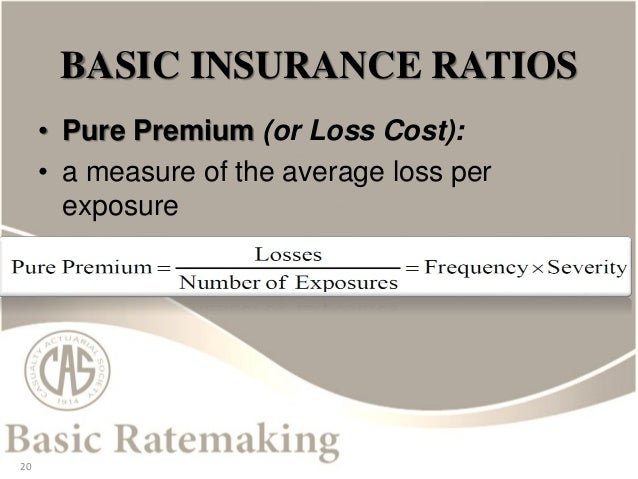

Pure risk premium calculation. The simplest premium calculation principle is called pure risk premium and it is equal to the expectation of claim size variable. 181 This premium is often applied in life and some mass lines of business in non-life insurance. Any amount that the investment returns over the 2-percent risk-free baseline is known as the risk premium.

For example the risk premium would be 9 percent if youre looking at a stock that has an expected return of 11 percent. The 11-percent total return less a 2-percent risk-free return results in a 9-percent risk premium. The risk premium is calculated by subtracting the return on risk-free investment from the return on investment.

Risk Premium formula helps to get a rough estimate of expected returns on a relatively risky investment as compared to that earned on a risk-free investment. Risk Premium Formula Ra Rf r a asset or investment return. Total cost of the insurance policy calculated simply as.

Premium Rate x Exposures If Premium is measured in units such as dollars Exposures in units such as Car. Pure risk premiums we will hencef orth us e the term prem ium m eaning pure risk premium is then equal to the expectation ie. P E h X.

In the case of no deductible the payment. The cost of equity is effectively the equity risk premium. R f is the risk-free rate of return and R m -R f is the excess return of the market multiplied by the stock markets beta coefficient.

Estimate your pure premium. A pure premium rate is an estimate of the amount an insurance company needs to collect to offset any potential claim on your policy. To estimate this take your potential loss and divide by the insurances exposure unit.

To calculate the pure premium for i-th risk we need to estimate E m θ i D m i E s 2θ i from suita-ble set of data. For the purposes of these parameters estimation we regard the particular i-th risk as one of a set of N risks. We assume that for each of the N risks we have n observed values Y ij of the aggregate claims in.

Pure risk is a category of risk that cannot be controlled and has two outcomes. Complete loss or no loss at all. There are no opportunities for gain or profit when pure risk is involved.

Pure risk premiums under deductibles 5 Franchise deductible cont. The pure risk premium under the franchise deductible can be expressed in terms of the premium in the case of no deductible and the corresponding limited expected value function. P FDa P EXa a1 F a.

This premium is a decreasing function of a when a 0 the premium. The premium calculation principle is one of the main objectives of study for actuaries. There seems to be full agreement among the leading theoreticians in the field that the insurance premium should reflect both the expected claims and certain loadings.

This is true for policy risk or portfolio. Premium has grown by an average of 95 per annum over the ten years to 1995 to reach around 35bn. During 1990-1992 soft rates together with a blight of recession related claims and the 1990 storms led to large losses.

Apart from this period the insurance returns have been good. The risk for a premium that is less than 8719 C will be able to invest the remaining assets net of premium and obtain a better return than by retaining the risk. If C cedes the risk for a premium of 610 the long-term effective rate of return will be.

60000-610 I 08005928 1 820. In general the greater the risk the higher the return that should be demanded. By understanding the differences in returns one can decide whether or not a risk is worth accepting.

Formula s to Calculate Risk Premium RISK PREMIUM PERCENT RETURN FROM AN INVESTMENT - PERCENT RETURN ON A RISK FREE INVESTMENT. Risk Premium and is denoted by RP symbol. How to calculate Risk Premium using this online calculator.

To use this online calculator for Risk Premium enter Return on Investment ROI ROI and Risk Free Return Rf and hit the calculate button. Here is how the Risk Premium calculation can be explained with given input values - 499988 500000-12. The pure risk premium in the case of the fixed amount deductible of b is given by PFADb P EX b PFDb b1 Fb.

As previously the premium is a decreasing function of b for b 0 it gives the premium in the case of no deductible and if b tends to infinity it tends to zero.