We are incentivized to do more regardless of whether more means better care and both we and our patients are blinded to whatever risks are inherent in this system. Moral hazard is the name given to the negative behaviour that can arise from an individual being insured.

What is moral hazard as it relates to health care.

What is moral hazard as it relates to healthcare. Moral Hazard and Health care Posted on April 14 2016 by Cole Driscoll No Comments Moral Hazard is a term that Economist are familiar with when discussing market failures or the inefficient allocation of resources. The definition of moral hazard is when there is hidden action taken by one party that incurs costs of another party. For more than 30 years most health care economists in the United States have accepted a conventional theory of health insurance based on the concept of moral hazard.

An assumption is made that insured people overuse health care services because they have insurance. The recent trend toward consumer-driven health care CDHC is advocated by its supporters based on this same premise. Moral hazard is a term used in economics in relation to an individual who is willing to take risks because he or she will not have to bear the cost of his or her action.

A moral hazard exists where one party in a contract assumes the risks associated to the other party without suffering any consequences. Moral hazards can be found in. Health care has many moral hazards and perhaps none is bigger than fee for service.

Heres the usual argument. We are incentivized to do more regardless of whether more means better care and both we and our patients are blinded to whatever risks are inherent in this system. While there are many risks in fee for service I believe none is greater than our inability to cap.

Moral hazard it has been conjectured that health insurance may induce individuals to exert less unobserved effort in maintaining their health. For example Ehrlich and Becker1972modeledhealthinsuranceasreducingindividualsunobservedeffortin maintaining their health. Because health insurance covers some of the financial costs.

Enrollees had to pay an additional 60 a month in premiums in order for this plan to break even. Overall the study concludes that moral hazard accounted for 2117 or 53 percent of the 3969 difference in spending between the most and least generous plans. It attributes the remaining 47 percent to adverse selection.

Another moral hazard may emerge with a vaccine assuming it is safe. People who refuse vaccination will clearly slow the defeat of COVID-19 and a botched vaccine that caused harm would undermine public trust in public health. But even among those who do choose to get vaccinated theres likely to be at least some moral hazard especially if people believe inoculation guarantees immunity.

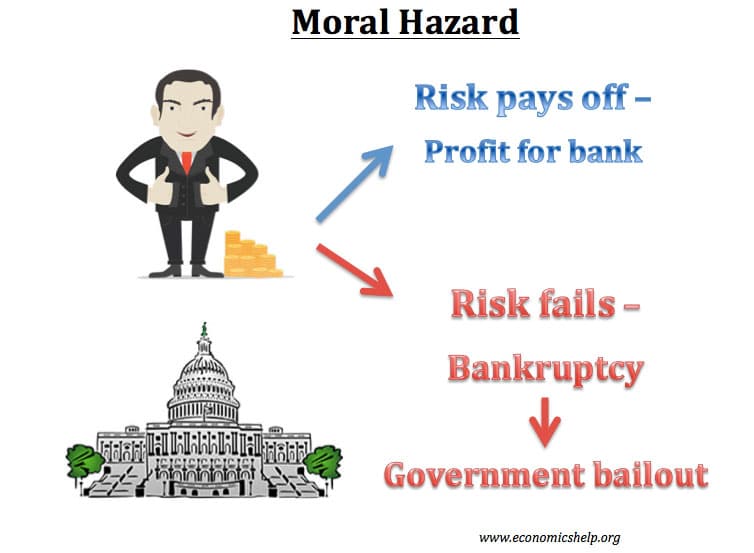

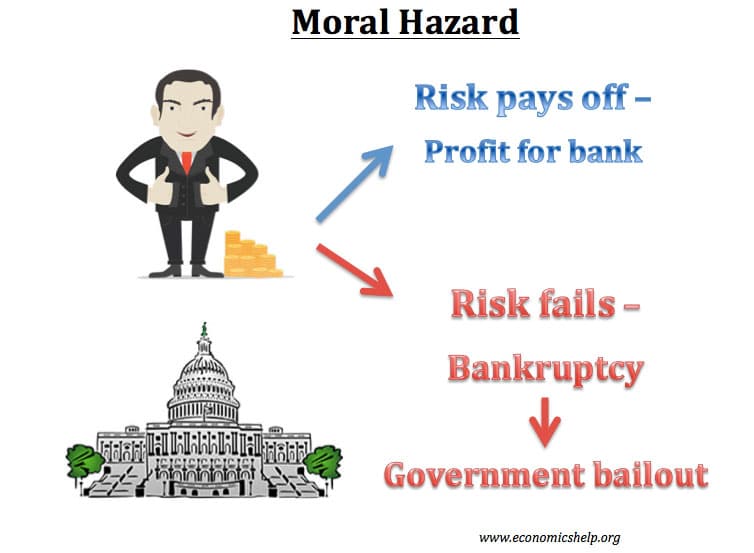

Moral hazard is the risk that a party has not entered into a contract in good faith or has provided misleading information about its assets liabilities or credit capacity. Moral hazard is related to adverse selection or the tendency of people with higher levels of risk to purchase more generous insurance coverage. When people believe they are likely to suffer a loss they may prefer to have another entitylike an insurance company pay the costs.

Moral hazard is a term describing how behavior changes when people are insured against losses. If for example your car is fully insured against any and all damage and there is no deductible then. Moral hazard is the name given to the negative behaviour that can arise from an individual being insured.

When an individual group or even country is insured they may take greater risks than if they are not insured. For example individuals who take out dental insurance may follow a less rigorous oral hygiene regime than those who do not. In the context of health insurance the term moral hazard is widely used and slightly abused to capture the notion that insurance coverage by lowering the marginal cost of care to the individual often referred to as the out-of-pocket price of care may increase healthcare use Pauly 1968.

In the United Statesthe context of all the work we cover in this papera typical health. Moral hazard is a situation in which one party gets involved in a risky event knowing that it is protected against the risk and the other party will incur the cost. It arises when both the parties have incomplete information about each other.

In a financial market there is a risk that the borrower might engage in activities that are undesirable from the lenders point. What is moral hazard as it relates to health care. Relate the idea of flat of the curve care to this.

Does any form of health care insurance create a moral hazard. That is unless you are willing to pay for health care out of your own funds are you over utilizing health care. If not then how can we ever know if the health care dollars spent on a patient are justified or not.

What informational issues are at work in health. 26 Arrow and Paulys positions and definitions of moral hazard in health insurance can be summarized as follows. For Arrow moral hazard is a practical limitation of the market for health insurance that can be overcome through social institutions it is a socialmoral issue.

The practical limitation is that contingent contracts cannot be written and insurance must therefore pay off through a reduction in the cost of. Moral hazard bilateral moral hazard and multitask moral hazard refer to agency problems that may arise after a contract is entered into between a principal and an agent ex post. An agency problem also exists even before a contract is signed ex ante.

This agency problem is known as adverse selection.